Looking for Payment Gateway Provider for Your Business?

The payment gateway is one of the most important factors in growing your business. Especially if you are running a business online through your Website or App, even offline businesses also require a payment gateway nowadays because this is a digital Era. Well lets dnt waste any more time and lets dive into what you are looking for. Look if you are here by searching what are the documents required for a successful sign up then your are on the right place here i will tell you the detailed list of the documents that you will need for onboarding.

What is Payment Gateway?

Payment gateway is a Digital process of transferring money when you buy or make a payment through internet. Its a technology that securely process your payment. There are lots of payment providers in the market who are already set their infrastructure with bank and Govt. and they are now ready to sale their services to business owners, for that you will need some necessary documents to get approval from them and as a business owners you should follow them and prepare your documents as per your chosen payment gateway provider.

Why Payment Gateway Provider Asked for Documents ?

Well, look its a matter of payment, right? Because every payment gateway provider needs to follow the Goverment guidelines on providing the payment gateway to business owners to give the facility to accept payment from customer on internet. Otherwise there will be a risk for payment fraud, because everyone(who doesn’t have any documents or legal business) will signup and try to accept payment or may be try to do fraud. That’s why as per Goverment rules, every payment provider needs some documents of business proof is required. Otherwise merchant as well as the payment provider will have thier business at risk for rejection.

Here i will list the top 3 Payment Gateway Providers in 2024 and their checklist for documents. And by the way this 3 company i will listed here is mostly famous in india.

One more thing, you guys may think who am i to tell you guys this things. Well let me give you my small introduction about who am I. My name is Jogen Rabha and i am a website developer since 2016. I have developed 255 websites in 7 Years and trust me i have onboarded over 80+ websites for payment gateway, mostly those are ecommmerce and digital course selling websites and NGOs. So i know what i am talking about here, also in this top 3 list of payment gateway who’s documents checklist we will be discussing here i have filter them manually by checking their onboarding process by myself. And i have provided the list who are very easy to onboard and provides good response to merchants.

Top 3 Payment Gateway Provider and Their Documents :

1. Instamojo :

On the number 1 list i have kept Instamojo because its very simple and has easy to use interface and instamojo is very convenient for Individual and i think this is the main point i want to know my audience because in India 70% businesses are startup & individual, they dnt have much documents of their business. Instamojo provide the individual onboarding facility in such a smooth way. User can give their Pan, Aadhaar and Signature with MSME which can be free to get(AAdhar Udyog) and they can get approval in 2 days, its that simple that’s why i have kept instamojo on the number 1 list. Normally Instamojo takes 2 to 4 days for new application to give approval.

Here are some Screenshoots of Instamojo Dashboard.

Main Dashboard

Reports Dashboard

Payment Page Interface

QR Payment Page

Detailed list of documents required by Instamojo :

For Individual :

| PAN of Owner | Mandatory | Scan of PAN |

Bank Account of Proprietorship Concern | Mandatory | |

| Acceptable Documents (Any ONE) | ||

| Scan of cancelled cheque leaf | ||

| Scan of bank statement (last 3 months) | ||

Individual Address Proof | Mandatory | Acceptable Documents (Any ONE) |

| Aadhaar (Needs to be masked, worst case, we will mask it internally) | ||

| Passport | ||

| Voter ID | ||

| Driving License | ||

Business Address Proof | Mandatory | GST Certificate |

| Shops and Establishment Certificate | ||

| Gumasta Certificate | ||

| Utility Bill (Eg: Electricity bill, Water bill, Phone bill, etc) | ||

| Udyog / Udhyam | ||

| Tax Documentation | Optional | GST Certificate |

| Category Specific Documents | Mandatory | For conditional documents (refer conditional documentation sheet)This is MANDATORY if the business comes under any category that is defined in the Conditional Documentation checklist |

For Entities :

Private Limited

Mandatory Documentation:

- Certificate of Incorporation

- Articles of Association

- Memorandum of Association

- Any 2 Directors PAN and Address proof (Aadhar/Driving license/Voter ID/passport) of the same directors who have signed on the Board of resolution.

Common Documents for All Entities:

- PAN of Entity (Scan of PAN)

- Bank Account of Entity – Mandatory

- Acceptable Documents (Any ONE):

- Scan of cancelled cheque leaf

- Scan of bank statement (last 3 months)

- Acceptable Documents (Any ONE):

- Address Proof – Mandatory

- Acceptable Documents (Any ONE):

- Certificate of Incorporation

- GST Certificate

- Utility bill (e.g., electricity bill, phone bill, etc.)

- Any government document with the address

- Acceptable Documents (Any ONE):

- Tax Documentation (Optional): GST Certificate

- Business Constitution Documentation: Mandatory (Refer to Column B in the same sheet)

- Government Documentation: Acceptable Documents (Any ONE)

- GST Certificate (Optional)

- Shops and Establishments Certificate

- Udyog / Udhyam

- Any other business registration documentation with the government

- Ultimate Beneficiary List – Mandatory

- Names & shareholding % (Format shared by Prathap)

- Authorization for Signatories – Mandatory

- Board Resolution (Should not be older than 6 months, on the company’s letterhead along with 2 directors sign and company’s seal).

LLP

Mandatory Documentation:

- Registration Certificate

- Partnership Deed

- Any 2 partners PAN and Address proof (Aadhar/Driving license/Voter ID/passport) of the same partners who have signed on the Board of resolution.

Common Documents for All Entities:

- Same as Private Limited Entity (Refer to Common Documents for All Entities).

Partnership (Unincorporated)

Mandatory Documentation:

- Partnership Deed

- Any 2 partners PAN and Address proof (Aadhar/Driving license/Voter ID/passport) of the same partners who have signed on the Board of resolution.

Common Documents for All Entities:

- Same as Private Limited Entity (Refer to Common Documents for All Entities).

- Check if this has a list of current partners.

2. CCAvenue :

On the list i have kept CCAvenue on number 2 because this company also provide a Unique and Amazing features which is one you submitted your all required documents on the gateway it will give you immediately live mode access, however the transaction amount will not settle in your account until your KYC verified by CCAvenue Team. But still its a good features because instantly you can try with your app and website wheather it is working fine or not. This features is very useful for website and App developer because once the website is complete they can show their work instantly to their clients and get approval of their project. And other features like response from team is good to. Normally CCAvenue takes 7 to 15 days for new application to give approval. You guys can go for it.

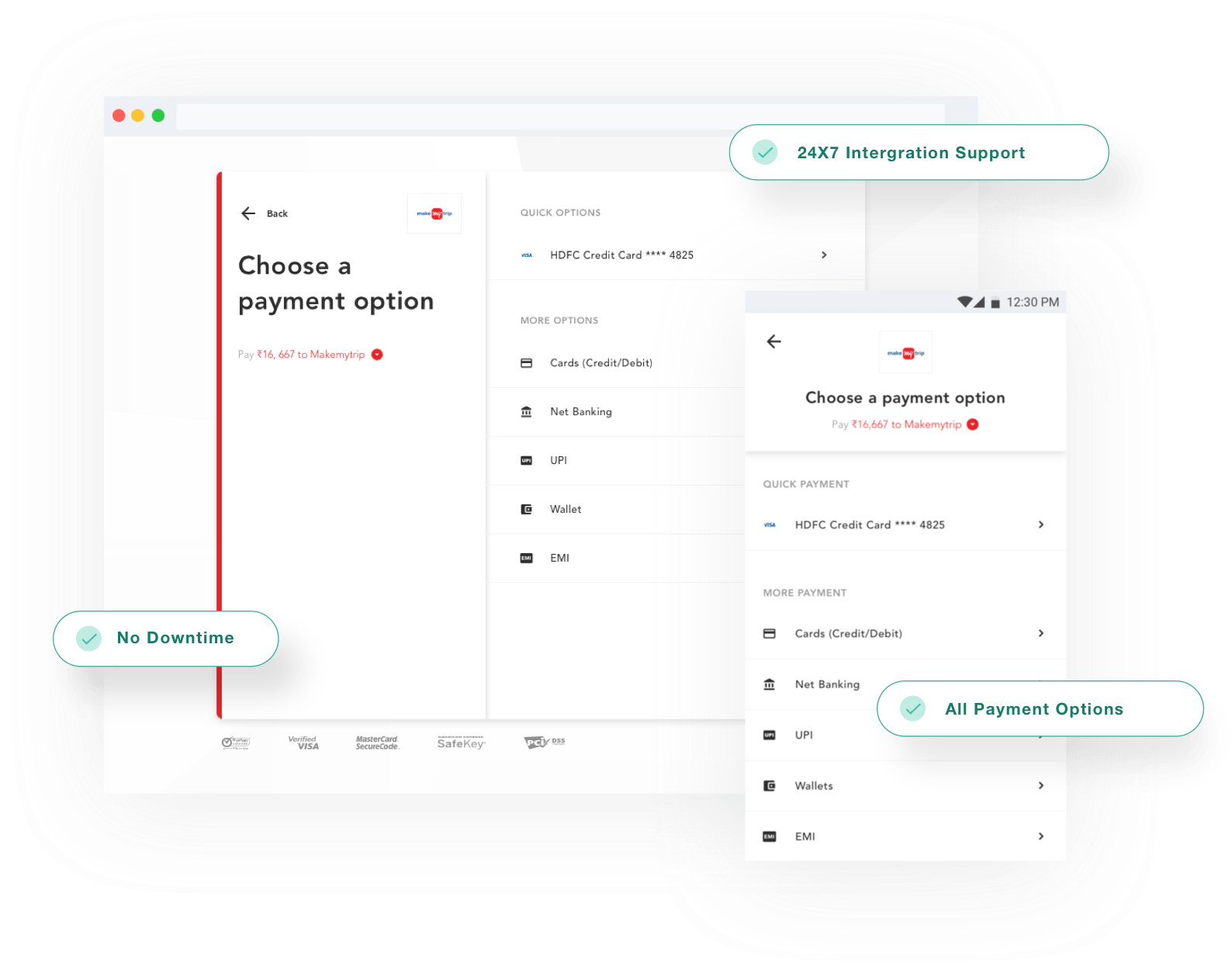

Here are some Screenshoots of CCAvenue Dashboard.

Main Dashboard

Wallet Payment Page

Net Banking Payment Page

Credit & Debit Card Payment Page

Detailed list of documents required by CCAvenue :

| Individual | Required KYC Documents (Scan Copy) |

|---|---|

| KYC Documents | A clear visible copy of your PAN card (scan). |

| Office Address Proof | Landline telephone bill or Passbook or Aadhar Card OR Passport (scan). |

| Voided Cheque | Scanned copy of a voided cheque (cancelled cheque) for the bank account. |

| Sole Proprietor | Required KYC Documents (Scan Copy) |

|---|---|

| KYC Documents | PAN card of proprietor (scan). |

| Office Address Proof | Landline telephone bill or Bank Statement (latest – for the last 2 months) duly attested (scan). |

| Voided Cheque | Scanned copy of a voided cheque (cancelled cheque) for the bank account. |

| Additional Documents | GST Registration Certificate Scan Copy OR Tax Registration / Income Tax Registration / Municipal Registration: Copy of a license issued by governing councils (scan). |

| Partnership | Required KYC Documents (Scan Copy) |

|---|---|

| KYC Documents | PAN Card of the Firm and Authorized Partner. |

| Office Address Proof | Landline telephone bill or Bank Statement (latest – for the last 2 months) duly attested. |

| Voided Cheque | Scanned copy of a voided cheque (cancelled cheque) for the bank account. |

| Additional Documents | GST Certificate Scan Copy, Copy of Partnership Deed duly attested by an authorized Signatory. |

| Limited Liability Partnership | Required KYC Documents (Scan Copy) |

|---|---|

| KYC Documents | PAN Card of Company and Authorized Signatory. |

| Office Address Proof | Landline telephone bill or Bank Statement. |

| Voided Cheque | Scanned copy of a voided cheque (cancelled cheque) for the bank account. |

| Additional Documents | LLP Agreement & Certificate of Incorporation, GST Registration Certificate Scan Copy, Board Resolution on company letterhead: Signed & stamped by at least 2 Partners. |

| Private / Public Limited | Required KYC Documents (Scan Copy) |

|---|---|

| KYC Documents | PAN Card of Company and Authorized Director. |

| Office Address Proof | Landline telephone bill or Bank Statement. |

| Voided Cheque | Scanned copy of a voided cheque (cancelled cheque) for the bank account. |

| Additional Documents | Entire Copy of Memorandum & Certificate of Incorporation, GST Certificate, Board Resolution on company letterhead: Signed & stamped by at least 2 Directors. If Board resolution is not signed by Directors mentioned in MOA then Company Secretary can sign and with the designated stamp. |

| NGO’s / Trust / Society / Association | Required Documents |

|---|---|

| Trust / Society / School of Resolution | Duly signed by at least TWO Trustees / Members with rubber stamp. |

| PAN Card (Trust / Society / School & Authorized Signatory) | |

| Organization Address Proof | Landline telephone bill OR electricity bill OR Bank Statement. |

| Voided Cheque | Scanned copy of a voided cheque (cancelled cheque) for the bank account. |

| Additional Documents | Trust Deed / Bye Laws / Memorandum Of Understanding (MOU) along with Registration Certificate, Relationship Letter as per attachment. |

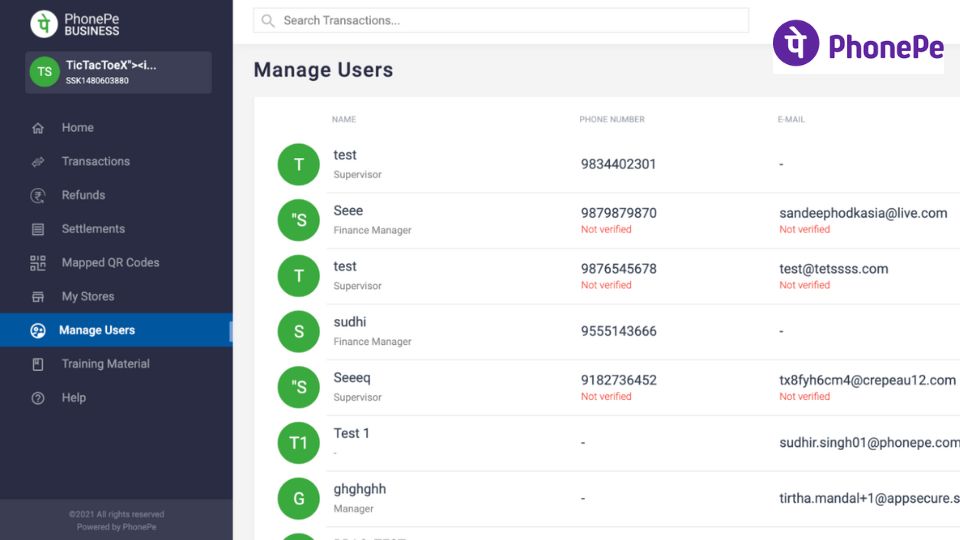

3. PhonePe :

Phone pe is one of the most used UPI app india, it has 500Million+ Active Users in india only, is not that amazing? A good thing about phone pe is that it has amazing customer support in onboarding process. Also the secret of 500M+ users is that phonePe provides Free UPI transaction. No Hidden Fee or anything, which makes this company standout of others. Normally PhonePe takes 5 to 7 days for new application to give approval.

Here are some Screenshoots of PhonePe Dashboard.

Main Dashboard

Main Payment Page

Detailed list of documents required by PhonePe :

Proprietorship:

- Email ID

- Phone Number

- Pan Card

- Cancelled Cheque/Bank Account Statement

- Website URL

- GST Certificate (All 3 Pages) if applicable

Partnership or LLP:

- Partnership Deed

- Email ID

- Phone Number

- Owner Pan Card

- Cancelled Cheque/Bank Account Statement

- Website URL

- GST Certificate (All 3 Pages)

- Attached Document (Signed & Stamped)

- Company Pan Card

Private Company:

- Certificate of Incorporation (COI)

- Email ID

- Phone Number

- Owner Pan Card

- Cancelled Cheque/Bank Account Statement

- Attached Document (Signed & Stamped)

- Website URL

- Company Pan Card

- GST Certificate (All 3 Pages)

Trust / NGO:

- Website URL

- Email ID

- Phone Number

- Cancelled Cheque/Bank Account Statement

- PAN card

- Trust Deed

- GST Certificate (if present)

So it was the complete list for documents required of the mentioned Top 3 Payment Gateway. I hope you guys find this useful. And one more important thing i wanna tell you this all above mentioned payment gateway requires a working website to get approval and make sure you update all your legal pages like, Privacy Policy, Terms and Conditions, Refund Policy, Shipping Policy, Disclaimer, About us, Contact us and Donation Policy if it is a NGOs, Not for Profit Business.